Equity Statement

Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

What is an Equity Statement?

An equity statement – also referred to as a statement of owner’s equity or statement of changes in equity – is a financial statement that a company is required to prepare along with other important financial documents at the end of a reporting period. In the United States, the statement of changes in equity is also called the statement of retained earnings .

The statement of owner’s equity reports the changes in company equity. The changes that are generally reflected in the equity statement include the earned profits, dividends, inflow of equity, withdrawal of equity, net loss, and so on.

Summary

- Equity, in the simplest terms, is the money shareholders have invested in the business including all accumulated earnings.

- An equity statement is a financial statement that a company is required to prepare along with other important financial documents at the end of the financial year.

- The statement of owner’s equity reports the changes in company equity, from an opening balance to and end of period balance. The changes include the earned profits, dividends, inflow of equity, withdrawal of equity, net loss, and so on.

Equity, in the simplest terms, is the money shareholders have invested in the business. It constitutes a part of the total capital invested in the business, which doesn’t belong to debt holders.

Equity on the Balance Sheet

On the company’s balance sheet, shareholder’s equity is represented under the heading “Shareholder’s Equity” or “Stockholder’s Equity.” The section usually comprises three components:

- Share capital

- Retained earnings

- Net income

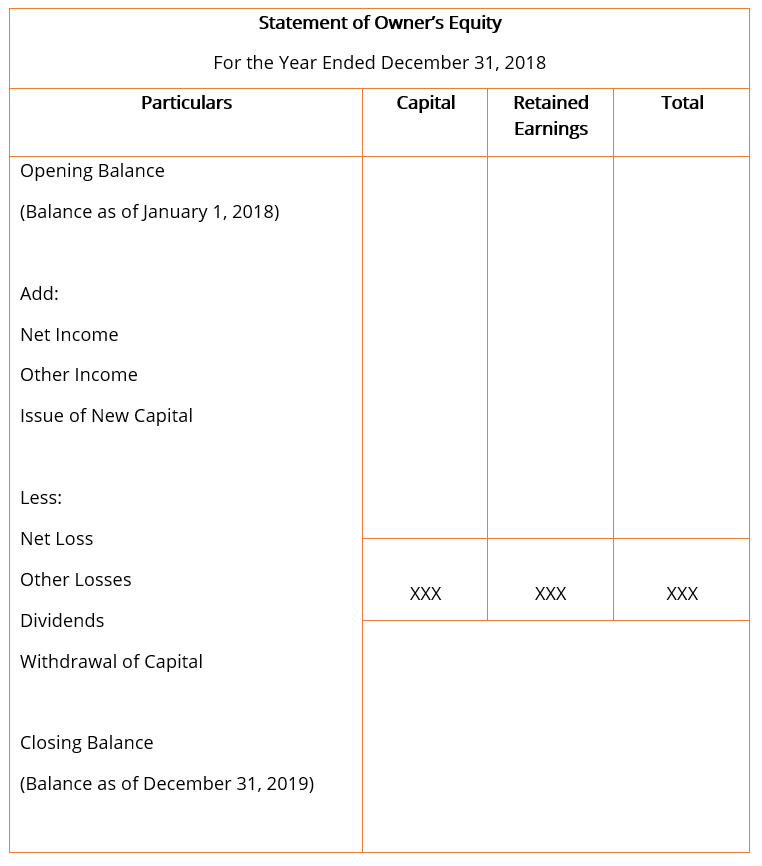

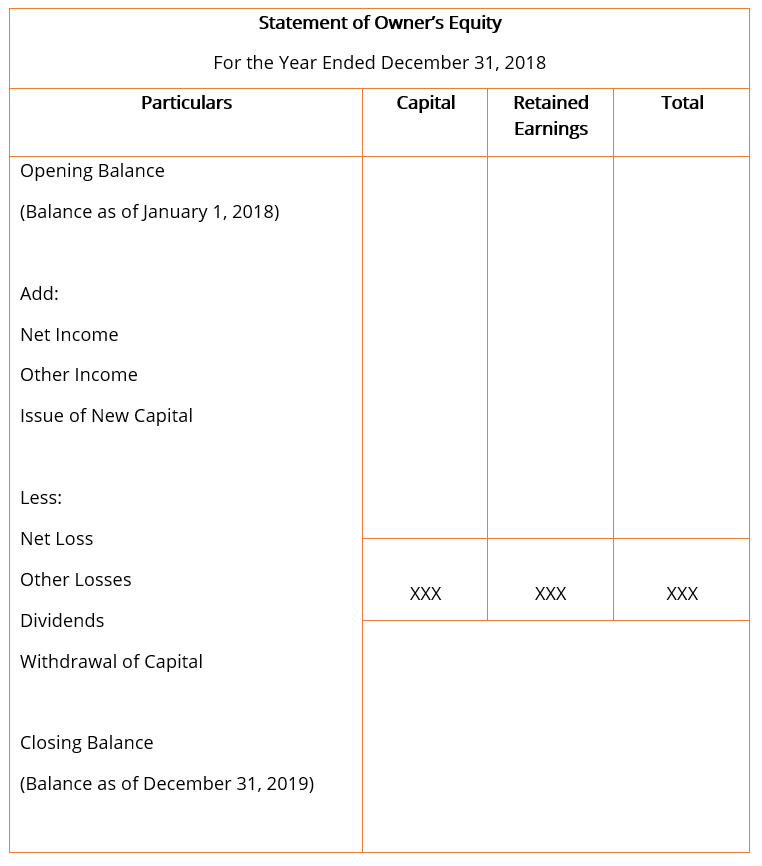

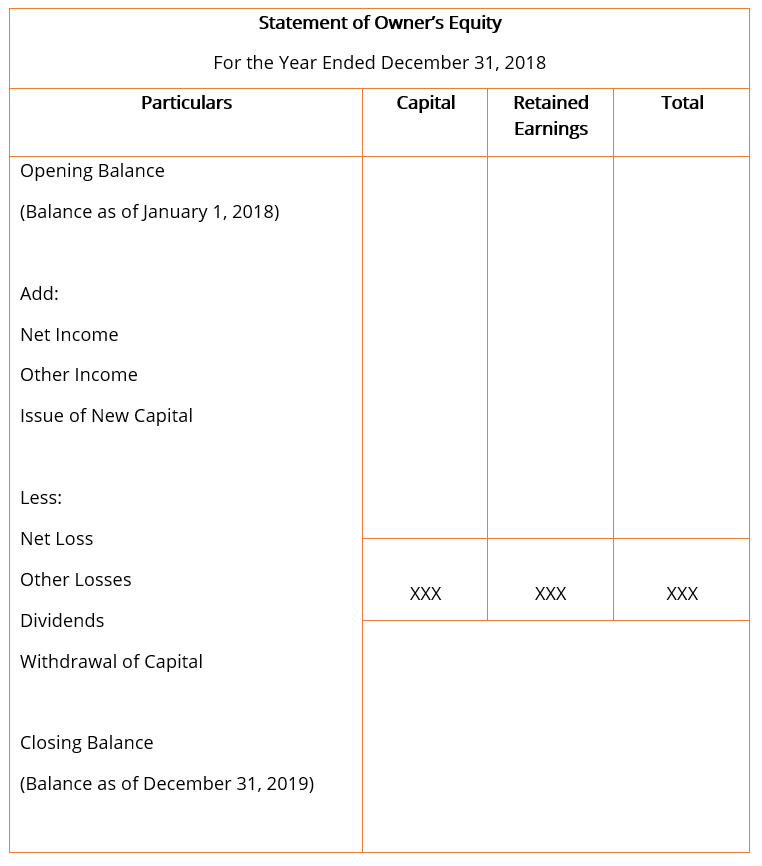

The general format for the statement of owner’s equity, with the most basic line items, usually looks like the one shown below.

Line Items

- Opening Balance: The opening balance is the ending balance of the previous year’s statement of shareholder’s equity. All further additions and subtractions in the current financial year are made to the opening balance in the equity statement.

- Net Income: Net income is the total income earned by the company during the fiscal year, after accounting for all operating and non-operating expenses. The value is taken from the income statement, also known as the profit & loss statement, that is prepared at the end of the fiscal year.

- Other Income: All additional income earned by the company that might not have been recognized in the income statement is accounted for on the equity statement. Examples of other income include actuarial or unrealized gains from financial instruments.

- Issue of New Capital: When new shares are issued and when there is an inflow of capital or an addition to the shareholder’s equity in the company, it is added to the total shareholder’s equity.

- Net Loss: Net loss is the loss incurred by the company during the fiscal year as a result of its operations. It reduces the company’s total capital and is hence deducted in the statement of shareholder’s equity.

- Other Loss: Just like other income, the expenses incurred or loss that is incurred by the company but not recognized in the income statement is accounted for in the equity statement. A good example of other comprehensive losses is actuarial or unrealized losses form financial derivatives.

- Dividends: A dividend is a reward or return earned by the shareholders of the company on their investment in the company’s shares. The dividend payments made to the shareholders reduce the total shareholder’s equity of the company and are hence deducted in the statement of shareholder’s equity.

- Withdrawal of Capital: When shares are redeemed or capital is withdrawn from the company, it is shown as a deduction in the statement of shareholder’s equity, as it reduces the total equity of the company.

Related Readings

Thank you for reading CFI’s guide to Equity Statement. To keep learning and advancing your career, the following resources will be helpful:

- Dividend Policy

- Equity Template

- Profit & Loss Statement

- Three Financial Statements

- See all accounting resources

Get Certified for Financial Modeling (FMVA)®

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.