![]()

A company’s financial figures can either attract investors or drive them away. This is the importance of accurate financial ratio analysis, which is true for tech companies.

In contrast to most businesses, tech firms often only have intangible assets. Their inventories are practically non-existent, as they typically rely on software or intellectual property. Further compounding the issue are the large sums of debt they incur. As a result, financial officers and investors use financial ratios to avoid financial risks.

In this article, we’ll discuss the different types of financial ratios, how to calculate them, and how the technology industry can benefit from them.

In this articleCertain figures in financial books reveal a company’s potential and viability: assets, liabilities, revenues, and expenses. Financial ratios are numerical expressions showing how these different figures relate to one another.

They give you multiple perspectives on a company’s financial health. This includes:

Financial ratios can help define pivotal business decisions, including whether to invest in new technology or expand into new markets. Both decisions carry significant costs and risks. Ratios assess the potential profitability and efficiency of these investments, which can help you determine the best course of action to maximize profit. Since they indirectly assess areas like operations and management, among others, they also assess a company’s overall performance.

Comparing your present ratios with past data can help identify progress or regression in performance. Meanwhile, comparing your ratios with the rest of the industry can help identify strengths and weaknesses in your financial and operational processes. This allows you to make adjustments or adopt strategies used by your competitors.

(Also Read: Limitations of Ratio Analysis in Financial Management )

The tech industry relies on several critical financial ratios for analysis and decision-making. Here are some of the most important ones:

These assess a company’s ability to convert assets into cash to pay short-term debts. They are crucial since many tech companies struggle to generate revenue and may need to liquidate assets to cover due debts.

This ratio, also known as the working capital ratio, measures a company’s ability to pay off current liabilities, taking into account all of its assets. This ratio is crucial for tech firms since they need to have enough liquid assets to pay off investors and sustain their progress.

The formula for the current ratio is:

Where Current assets include:

Current liabilities include:

The average current ratio for tech companies usually falls between 1.5 and 3, although this can vary by sector. This range ensures enough liquidity to cover current debts. A ratio below one, however, can raise concerns about your ability to pay your dues.

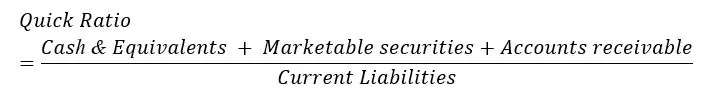

The quick ratio, or acid-test ratio, measures a company’s capability to pay off due debts using only assets that can be converted to cash within a year or less. In short, it removes inventory and prepaid expenses from the equation. This is beneficial for tech startups with limited cash and no inventory.

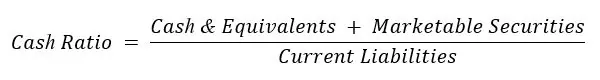

The cash ratio shows a company’s ability to pay short-term debts using only its most liquid assets–cash and short-term investments. This ratio is critical for tech firms with inconsistent cash flows since it gives the most precise picture of liquidity. A strong cash ratio means you can sustain your operation even in the face of unexpected expenses or seasonal fluctuations.

These ratios help us understand how well companies make money from sales. Examining these ratios can help reveal a company’s potential for long-term growth and market share despite current financial losses.

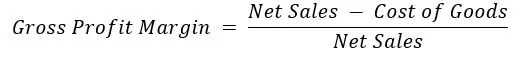

This ratio measures the total amount of money you earn from sales before deductions. It shows how well a company manages its production costs, such as raw materials and labor, to produce its goods.

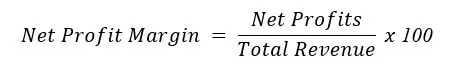

Net profit margin shows how much profit a company makes from its revenue. It encompasses all business aspects–production, administration, and financing–making it a key indicator of overall profitability.

Net Profits = Total Revenue – Total Expenses

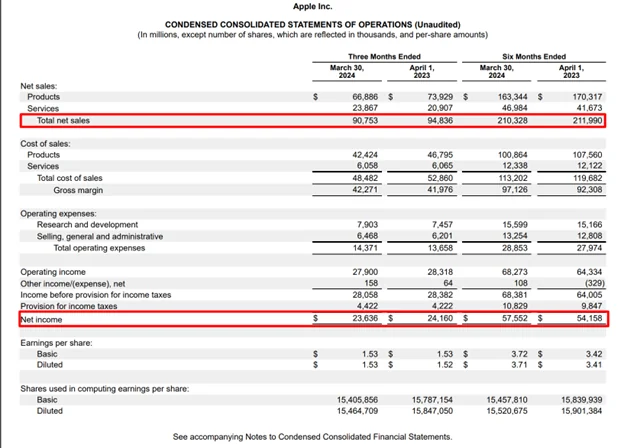

Let’s apply this formula to one of the world’s largest tech companies–Apple. Here is a portion of for the quarter ending March 30, 2024:

Using the equation ($23.6 billion ÷ $90.8 billion) × 100, we get 26.0%. This means the company kept $0.26 for every dollar generated in sales.

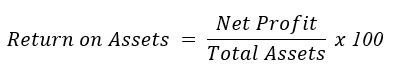

Return on Assets (ROA) measures your company’s profitability relative to its total assets. It shows how effectively you use your assets to generate profits. A higher ROA indicates that you use fewer assets and incur lower costs to generate income.

These financial ratios help you see the potential profit or return on investment from the money you spend on operations.

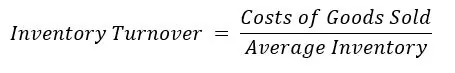

Inventory turnover measures how many times your company’s inventory is sold and replaced over a period, typically a year. This is critical for tech companies whose products often have short life cycles, and unsold inventory can be extremely costly.

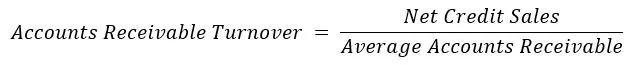

Accounts receivable turnover measures how often a company collects its accounts receivable and how efficiently its credit policies and collection processes work. This allows you to adjust your receivables management so you can maintain a consistent cash flow and reduce bad debt.

These are also called financial leverage ratios. They measure a company’s ability to manage its long-term debts, unlike liquidity ratios, which focus more on the short term.

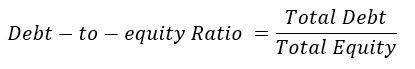

The D/E ratio compares a company’s total debt to its shareholders’ equity. It reveals the extent to which the company leverages debt to finance its operations and acquire assets rather than using its own funds.

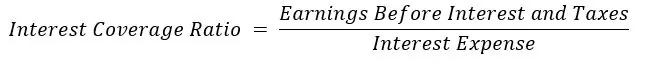

The interest coverage ratio shows us how well a company can cover its interest payments with its earnings. A higher ratio signifies greater earnings compared to interest expenses, lowering the risk of defaulting.

These measure and analyze your stock value and compare it with that of your competitors. They determine whether a company is truly worth the investment and is not underpriced due to hidden issues.

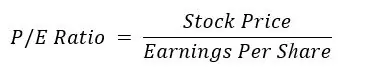

This can determine whether a technological firm is overvalued or undervalued by comparing its current share price to its earnings per share (EPS).

EPS is usually found in earnings releases or by trailing a company’s performance in a year.

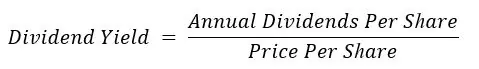

The dividend yield, on the other hand, can help investors determine the returns they can expect from dividends alone. A consistent or rising dividend yield suggests a tech company has enough profit to reward its shareholders. Investors should still exercise caution, however, as it might also be due to a declining stock price.

Where annual dividends per share are the total dividends divided by the shares outstanding. You can use the dividends from the last full year’s financial report or the last four quarters.

Integrating financial ratios can help you identify strengths, weaknesses, opportunities, and threats (SWOT analysis).

Here’s how to include them in your planning:

Although financial ratios are powerful tools, they have their limitations. Failing to consider these limitations can harm your business instead of benefiting it.

A common pitfall in financial ratio analysis is the likelihood of misinterpretation. Never assume a single ratio paints a complete financial picture. Instead, you should analyze them in conjunction with other metrics and within the broader context of the business. Failing to account for seasonal fluctuations and significant economic downturns can also skew results.

Additionally, some companies manipulate their records to gain the upper hand. Theranos is a perfect example. They falsely claimed expected revenues of over $100 million. Investors relied on these figures, which potentially skewed their financial ratios, eventually causing severe losses.

Financial, operational, and management processes also vary between industries due to industry-specific standards and regulations. This makes cross-industry comparisons complicated and prone to inaccurate interpretations.

There are numerous ways to analyze financial ratios. Two of the more advanced techniques include:

Two emerging technologies are making a great impact on the finances of businesses worldwide: AI and Machine Learning. By analyzing more extensive data sets, these two can improve the accuracy and predictive power of financial ratios.

They can even help increase revenue. In one survey, companies using these emerging technologies had 58% faster revenue growth compared to non-users and 80% faster profitability growth.

Financial ratios are now also used for predictive analytics. They can identify patterns in a company’s financial performance, helping forecast future profitability, liquidity, and financial stability.

If you want to learn more about financial ratio analysis, the internet has a wealth of resources. If you’re a beginner and want more comprehensive information, look to online course platforms:

If you simply need a refresher or need information quickly, visit websites like Investopedia or The Balance. These websites offer tutorials for various financial concepts.

If you’re looking for tools to streamline your financial analysis, here are some popular options:

Cash flow ratios measure a company’s capability of paying off due debts using only cash earned within a certain period.

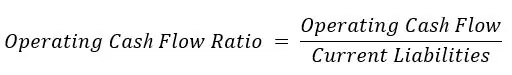

The operating cash flow ratio measures a company’s ability to cover its short-term liabilities using only cash generated from operations. It is calculated as:

Since it only focuses on operating cash flow, it’s a more accurate measure of a company’s liquidity. A high ratio means your business operations are bringing in enough cash to cover your liabilities.

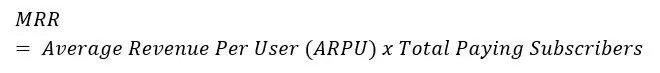

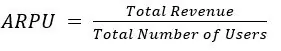

Owing to the unique nature of their business model, SaaS companies rely on industry-specific metrics that track and analyze the number of users they enroll and keep.

The MRR measures the total recurring revenue a SaaS company generates on a monthly basis. This metric can forecast future revenue and assess how effective your customer acquisition and retention strategies are. The formula for Monthly Recurring Revenue is:

Financial ratios are a necessity for technology industry decision-makers. Their continuous drive to push their companies forward requires a clear understanding of their company’s financial health. Integrating financial ratio analysis into regular business planning enables business leaders to evaluate their own performance and strategize for the future.

The power of financial ratios will only grow. As AI, Machine Learning, and Cloud Systems continue to advance, new methods of analysis will also emerge. These new tools will give us more accurate forecasts. With the added accuracy, we can confidently navigate financial uncertainties and capitalize on new opportunities.